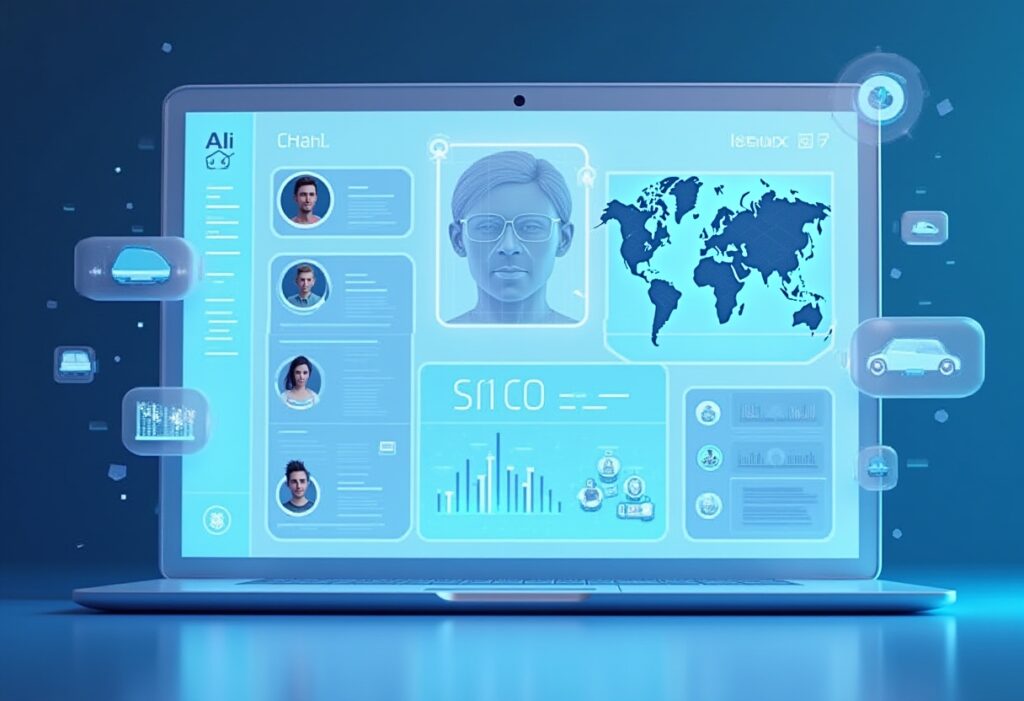

Gain deeper customer insights with our AI-powered profiling engine. By analyzing behavior, lifestyle, spending, and mobility data, we create dynamic profiles that help financial institutions predict needs, minimize risks, and deliver personalized solutions for stronger relationships.

Understand customers like never before. Our AI-driven profiling engine combines behavioral patterns, spending habits, and mobility data to create dynamic profiles — enabling banks to deliver personalized products and smarter engagement strategies.

Go beyond traditional credit scoring. Machine learning models analyze real-time context such as location, trip history, account balances, and spending behavior to generate more accurate risk assessments and uncover upsell opportunities that traditional systems miss.

Gain a clear understanding of how customers drive. By analyzing factors like braking, acceleration, speeding, cornering, distraction, mileage, and time of day, AiGenix creates a Safety Score that accurately reflects risk.

Transform raw data into actionable insights with intuitive dashboards and detailed analytic reports. Equip insurers, regulators, and fleet operators with the information they need for smarter underwriting, risk assessment, and claims management.

Ensure premiums reflect real driving behavior. By leveraging our advanced risk scoring, insurers can deliver transparent, equitable pricing that builds trust with drivers while encouraging safer roads.

Leverage geospatial data and behavioral patterns to forecast risk exposure, identify crash-prone segments, and design timely interventions.

Tell us a bit about yourself, and we’ll tell you a lot more about our solutions.

Transforming businesses with data-driven intelligence. Driving growth and efficiency through advanced analytics and behavioral insights.

Contact us

Email: contact@aigenix.ai

Location:

DUBAI – Head Office:

101, IFZA Dubai, Silicon Oasis, Dubai, UAE

KARACHI

The Centre, Plot#28, Sb-5, Abdullah Haroon Road, Saddar Karachi, Pakistan.

© 2025 AiGenix. All rights reserved.